Axis Communications: IP-based or analogue? Which option is really less expensive?

Axis Communications: IP-based or analogue? Which option is really less expensive? Before installing video surveillance, customers have to decide between an analogue or IP-based sys...

Axis Communications: IP-based or analogue? Which option is really less expensive? Before installing video surveillance, customers have to decide between an analogue or IP-based system. Both systems have technical advantages and disadvantages that have been debated intensively in the last few years. However, installers and security experts know perfectly well that customers often base their final decision on price, rather than technical merit.

Advocates of analogue video surveillance usually argue that IP network cameras are about 50% pricier than analogue ones. But this is only half the truth and it doesn’t reflect the fact that cameras are only one component of the overall video surveillance system. Buyers also need to factor in the other component costs of system maintenance, video recording and playback, installation, configuration, training and cable infrastructure.

Many installers, integrators or security consultants working with IP-based video systems are convinced that the overall costs to install IP-based video systems are lower than with analogue. But up until now, they had no data comparison to prove it.

Independent researcher, Chris Humphrey Consulting has stepped in to provide some clarity. Humphrey carried out a study comparing the costs of IP (Network cameras, IP infrastructure, server, video management software and storage) video surveillance systems and an analogue-based surveillance system (in this case analogue cameras and DVR based recording) to include the total cost of acquisition, installation and maintenance over three years.

Typical Site Comparison

In order to ensure the comparison was as unbiased as possible, the research scenario and characteristics of the installation were carefully chosen so as not to create an advantage for either the analogue or the IP-based system. “In order to be as objective as possible we spent a lot of time choosing the right scenario”, explained Chris Humphrey. “For instance a large site scenario with several buildings favours an IP based system since it allows utilising a shared network infrastructure for various data types and simplified remote ‘end to end’ management down to each individual camera location. Whereas an installation with 16, 32 or 48 cameras favours an analogue system since it has 16 DVR inputs.”

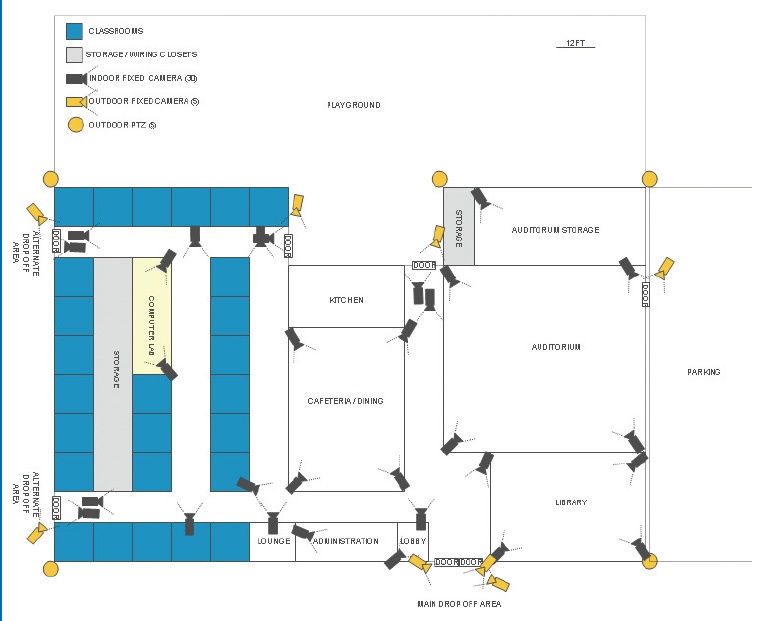

The research field the experts finally chose was a typical US mid-sized school campus with one existing building and no surveillance system in place. After clearing it with the school surveillance and security experts, the researcher defined requirements typically applied to school surveillance and provided them to the study participants throughout the US (integrators, resellers and installers) with a request for proposal.

Figure 1 shows the research scenario. For the IP system, Axis cameras were chosen, otherwise the participants had full autonomy to select equipment and set pricing for things like configuration, service or upgrades.

Clear Results

The findings revealed that the cost to acquire, install and operate an IP-based system was 3.4% lower than a traditional system consisting of analogue cameras and DVR-based recording. The results also unveiled a much higher range of costs between the cheapest and the most expensive IP-based solution. According to the numbers, the cheapest IP system cost 25.4% less than the cheapest analogue system while the most expensive IP system cost at least 11.5% more than the most expensive analogue system.

“The results show that IP-based video surveillance systems offer customers a better price while offering integrators and installers a more attractive margin,” said Chris Humphrey. “The reason lies in the wide flexibility IP based video surveillance offers through the use of technologies such as Power over Ethernet (POE). By contrast, the quotes for the analogue systems came in very similar which is actually very typical for an inflexible, mature market.”

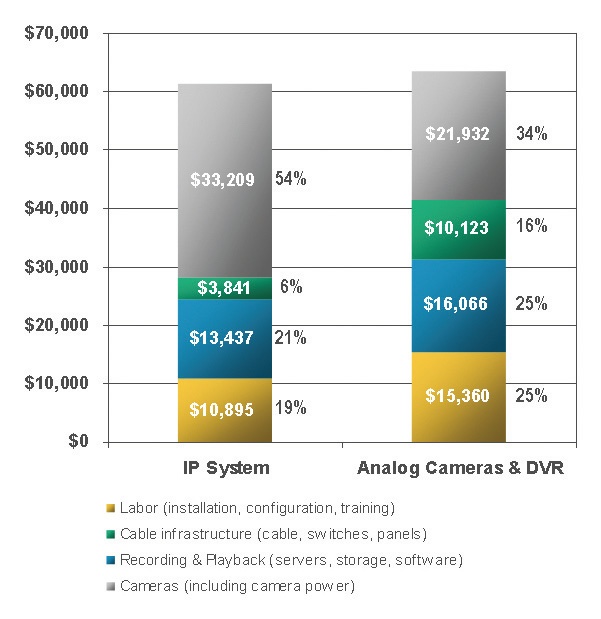

But how are the overall costs split and which are the most cost intensive components of each system? In order to give a more detailed answer the researchers assigned the single cost components to four different groups: cameras (including camera power), cable infrastructure (cable, switches and panels), recording and playback (servers, storage and software), labor (installation, configuration and training).

The results for the first group confirmed that network cameras are almost 50% more expensive than their analogue counterparts. A look at the costs in general (fig. 3) and the cost split (fig. 4) shows that actually the cameras are the most expensive component in the IP-based system and make up only one third of the cost in the analogue system. When it comes to the cable infrastructure in the analogue system the costs are almost three times higher than in the IP-based system. This is due to the fact that analogue cameras need a separate power cable. With PoE the power supply for the network cameras uses the same cable as that used for the network connection.

The same for the PTZ – analogue cameras need a separate cable to control PTZ cameras whereas IP cameras use the cable for the network connection. For recording and playback, the costs of both systems don’t vary much.

Labour Cost a Significant Factor

The important difference in the cost split of both systems lies in the last entry: labour costs. The labour required to install and maintain analogue systems is much higher than for IP based systems. This is crucial because labour costs do not allow installers or integrators to improve their margins. “Labour costs are very inflexible. In the analogue system, the integrators might earn more money on the cabling but the high labour cost gives them less flexibility with their overall margin and makes it much more difficult to meet deadlines,” summarizes Chris Humphrey.

“For the costs comparison one should not forget that the IP-based video market is a far cry away from being as mature as the analogue market. Therefore IT equipment is expected to fall in price faster than analogue equipment, making the comparison even more favourable in the future.”

For the scenario of one building with no infrastructure in place and 40 cameras to install, the cost advantages of the IP-based video surveillance system were clear. But the researchers also wanted to find out the break-even point of the IP-based system as a function of the number of cameras installed.

Using the research data, the study concluded that 32 cameras is the break-even point for IP-based systems versus analogue systems. An IP-based system will cost less than an analogue system if the installation includes at least 32 cameras. With any installation between 16 and 32 cameras, the cost of IP versus analogue is similar although slightly lower for analogue systems.

The research also showed that in facilities where IP infrastructure is already installed, IP-based surveillance systems would always cost less, even for systems of one to 32 cameras.

Decision-influencing Factors

During the research several interview participants gave further observations and cost considerations that favoured the IP based video system such as improved image quality, better maintenance and service, increased flexibility and easier troubleshooting. However, this information could not be included in the comparison because it was not quantifiable.

“There were many observations and cost considerations in the study that were non-quantifiable but showed major performance differences between the two systems,” said Fredrik Nilsson, general manager of Axis Communications. “Network cameras provide superior scalability, greater flexibility and image quality, and megapixel functionality. In addition, IP systems typically include better maintenance and service agreements for the equipment, plus they can be remotely serviced over the network for easier maintenance. IP systems clearly make the most sense both from economic and technological standpoints.”

Lists in detail the requirements the study participants had to meet

Number of cameras

- 30 indoor fixed dome cameras

- 5 Outdoor fixed dome cameras

- 5 Outdoor PTZ cameras

- All cameras needed to be vandal proof

Recording

- 12 hours of recording a day

- 4 fps continuous recording

- 15 fps recording on alarm/video motion detection

- CIF resolution

- Retention of video for 12 days

Monitoring Location and Equipment Placement

- Main Network Hub and Camera Viewing (location of Monitor, Server/DVR) in area labelled Administration (these are several offices).

- Network Switches (wiring closets) and/or Multi-camera power supplies can be placed in any “Gray Shaded” areas on diagram

Wiring

- Network Switches (wiring closets) and/or Multi-camera power supplies

- Plenum airspace above all areas (for cabling, plenum wiring required)

- Cat5e adequate for data wiring

- PoE switches can be located in storage area allowing for less than 76 metre PoE cable runs for network cameras

- Coax will have to be a home run from cameras to DVR

Contact:

Dominic Bruning

Axis Communications,

Preston, United Kingdom

Tel.: +44 870 1620 047

Fax: +44 870 7778 620

dominic.bruning@axis.com

www.axis.com

most read

Assa Abloy's battery-powered Aperio KL100 secures lockers

Boost workplace security and operational flexibility by securing more than just doors.

GIT SECURITY AWARD 2026 - The winners have been announced!

GIT SECURITY AWARD 2026: The best safety and security solutions of the year - now an overview of all winners

When the Internet stumbles: Why DNS is important

When DNS fails, the internet stumbles-AWS outage proves resilience and redundancy are vital for digital trust

Integrated and Futureproof: Traka’s Next Chapter

Interview with Stefni Oliver on Traka’s Vision for the Future

Safety and Security in an Emergency: How companies take responsibility with strategic personal protection and amok prevention

Personal protection & amok prevention: strategic concepts, training & responsibility for corporate safety and security