Merger of SeeTec and On-Net Surveillance Systems

At the beginning of April, the American VMS manufacturer OnSSI announced the signing of a binding agreement to take over the majority shareholding of the network video management s...

At the beginning of April, the American VMS manufacturer OnSSI announced the signing of a binding agreement to take over the majority shareholding of the network video management software pioneer SeeTec (we reported this on our online portal www.GIT-SECURITY.com). We spoke with Stephan Rasp, Chairman of SeeTec, and Gadi Piran, President and CTO, OnSSI about the background, motivation and plans.

GIT SECURITY: Mr. Rasp, market researchers at IHS confirm that the video surveillance industry is still a robust and growing market. Did the development of the market affect your decision on taking the next step towards being a global player?

Stephan Rasp: Definitely, yes! We have global partners, global customers and are operating in a global market. Whoever has the potential for global revenue will have more resources available to compete in the long run. The VMS market is still young and fragmented, which means that there is more technological progress ahead of us. Because this is complex technology in a complex environment, leadership does come with a price tag. SeeTec created the first commercially available open IP-based VMS. Our mission is to continue this tradition of innovation.

What does the merger mean exactly for SeeTec? Which impact does it have for the companies’ management? How will you handle synergies?

Stephan Rasp: The merger creates a long term and global perspective for SeeTec as one of the leading VMS manufacturers worldwide. It is hard to think of an alternative scenario to reach this objective. Both companies are going to grow as a result of the merger. OnSSI now has access to an up-to-date technology platform and SeeTec has access to a bigger market.

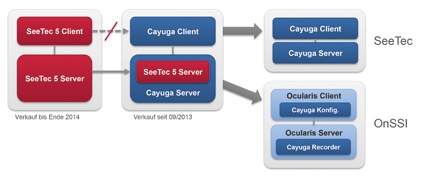

Gadi Piran: Structural integration is not planned. This would not create any savings considering the geographical distance, the different legal frameworks and lack of overlap in sales regions. The company’s management stays in place. We are pleased that the existing investors have been complemented by new ones. This way capital doesn’t drain off and we are able to focus on growth. Synergies are generated by licensing SeeTec Cayuga as a part of Ocularis in the US – this forms additional growth and stability. There are no plans to reduce the workforce. Quite the opposite: we are planning to strengthen development and services in Germany.

Will your existing customers profit from dealing with a global player in the future?

Gadi Piran: They profit in more than just one way: we are having a global presence for our global customers. We are increasing our development and service team not only in Germany but also worldwide. We are working on developing a global service organization to be in a position to support our integrators and partners in their projects all over the world. As a global company we have a different role in partnerships and more options than we had as a local player. As a result of the merger we remain hardware independent and open. We believe that this is a freedom of choice the customer wants.

Which new customers do you have in mind?

Stephan Rasp: We will focus on mid-size to large customers as we operate globally and are constantly increasing the capabilities of the software. We are noticing that video is evolving into a part of the IT-infrastructure. Thanks to the merger we are better prepared to support big and international roll-out projects. This is why we are going to step up our cooperations with globally acting partners, which opens further opportunities. Business video intelligence (BVI) is about supporting business processes with the help of video. SeeTec has a leading position in this new area of application. For example, BVI logistics is a product that helps the staff to find shipments in big logistics hubs by using video technology. This product will be on sale in the US. We received very encouraging and positive feedback at ISC West in Las Vegas.

SeeTec is successful with Cayuga in Germany and Europe – OnSSI with Ocularis in the US. Will there be a unification of the product portfolio? Will products disappear?

Gadi Piran: No. Both markets are different and have generated different products. From the technical point of view, SeeTec Cayuga is already a part of Ocularis 5. A big advantage is that we now have the innovative capacity of two exceptional teams. I am sure they will inspire each other and we will not have to invent things twice.

Is there a common strategic road map? Will there be jointly developed products that are better prepared for the global market?

Gadi Piran: With Ocularis 5 we introduced a first common product at ISC West in Las Vegas. Feedback from customers and partners has been positive. Even today, the requirements of the US market are considered in SeeTec Cayuga. It is interesting to note that the To-Do lists on both sides of the Atlantic are very similar – only the priorities differ.

What can the European VMS world learn from the American counterpart – and vice versa?

Gadi Piran: The operators work differently: in Europe, customers are looking for an event-driven automation and thinking in holistic processes. And of course privacy and data security play an important role. In the US it is more about tactical reactions in case of an event. Camera operation in live mode and access to the archive are critical. In this case the focus lies on operator efficiency. Both development teams are currently learning a lot from each other, giving us another unique opportunity for our customers.

Mr. Rasp, both SeeTec and OnSSI have sales structures that they have developed over the years. What kind of impact does the merger have on them?

Stephan Rasp: We complement each other’s sales structures perfectly. Each company has its own core market without any overlap. There are no duplicate offices. In a very few countries outside both core markets we are both represented by partners. We will not change anything in these countries and will continue to observe the market.

Are there any agreements or plans on doing a common sales and partner structure?

Stephan Rasp: Both companies rely on integrators and have a 100% partner-focused sales organization. We would like to offer our partners even more opportunities to reach unique added value based on our products. Both end customers and partners will benefit. We will support our global partners to apply the know-how they have gained in each of our products on a global scale. Each of us will sell his products in his own core markets. In the remainder of the markets we will be working together.

Business Partner

HexagonTallis House, 2 Tallis Street

EC4Y 0HB London

UK

most read

Is Your Venue Ready for Martyn’s Law?

Martyn’s Law demands stronger security by 2027. Is your venue prepared to protect and respond?

Safety and Security in an Emergency: How companies take responsibility with strategic personal protection and amok prevention

Personal protection & amok prevention: strategic concepts, training & responsibility for corporate safety and security

Training at Fraunhofer SIT: Strengthening resilience against cyber attacks

Knowledge in cyber security is evolving rapidly - continuous training is therefore important.

Airbus Defence and Space: Security as a strategic pillar of Europe's defense capability

Airbus Defence and Space protects sites, technologies and employees with modern security and cyber solutions - strengthening Europe's resilience in uncertain times

GIT SECURITY AWARD 2026 - The winners have been announced!

GIT SECURITY AWARD 2026: The best safety and security solutions of the year - now an overview of all winners