Security for Banking: Safe Cash Flow

In the banking sector, video technology has played a pivotal role in helping financial branches protect assets, prevent losses and enhance security as a whole.

Especially as banks around the world adapt operations for the “new normal,” it’s essential to put in place forward-thinking video security systems to establish an environment that is safe for all occupants and proactively monitors key areas while still being able to follow through with excellent customer service.

Modern-day financial institutions can achieve enhanced situational awareness and improve their protection of highly valued assets and people by leveraging innovative video capture technology. Manufacturers today have developed camera systems that are much smarter, capable and intuitive than what many branch and facility managers have been accustomed to in the past.

Better Image Quality

IP camera technology has made significant advances over just the past few years in providing state-of-the-art image quality. Far too often, banks decide that the existing analog cameras or first-generation digital video systems are still adequate, but in reality, there is tremendous benefit from implementing the latest IP video technology that far exceeds in performance.

High-resolution sensors on surveillance cameras greatly improve video footage simply by generating high-quality, crisp images. Video surveillance equipped with high resolution should, frankly, be integrated into every installation at a financial institution, particularly because money handling and most other detection and intelligent analytics require this technology.

Ensuring quality footage also involves two other IP camera innovations. First, without adequate lighting in an area, captured video will be dark and grainy, right? Wrong. In any lighting situation — whether that’s distorted light, high contrast, low light or no light — certain image processing technologies are able to dynamically compensate and adapt exposures. Simply put, lighting is directly correlated to exposure, but with multi-exposure high (or wide) dynamic range (HDR) technology, several sequential frames with different exposures are taken and merged using adaptive algorithms by selecting the best areas of exposure for realistic image quality in every frame.

Second, upgrading to an advanced IP video system also means that there will be more data captured, so setting up an efficient and secure storage strategy is key. However, when banks require maximized retention of video data to more effectively carry out security and monitoring operations, image quality can easily be sacrificed. Fortunately, smart compression technologies have been developed to increase the reliability and capacity of stored data, without compromising on quality. In some devices, it can lower bandwidth and storage requirements by up to 70% while retaining image integrity and critical video data for forensic purposes.

Full Coverage of High Traffic and Critical Areas

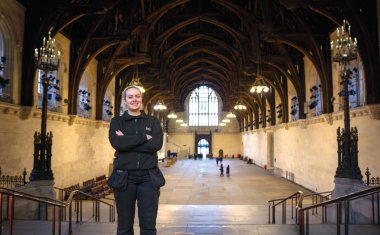

From public gathering spaces, to entry points, to vault areas, providing security officials with the ability to dynamically view entire areas, or zoom in, tilt and pan to a specific view, will improve a bank’s overall surveillance capability. After overcoming the challenges to return to normal daily business operations, it may be wise for financial institutions to consider installing panoramic cameras combined with fixed IP cameras at strategic locations. These video security devices will eliminate the need for extra coverage at blind spots, entrances or other vulnerable areas. Then, security management can ensure that they have wide visibility and the capability to pinpoint clear visuals of faces or precise activities at any time, as well as an instantaneous record of incidents that occur on the bank’s property.

With the right security technology placed at critical areas, integrated video can be effectively applied to improve security operations and prevent theft. For instance, vaults are highly valued areas that require extensive oversight; cashier desks should be closely monitored to gather relevant information about a variety of transactions; and workrooms in general need to be observed when a safe is opened and money is counted. Additionally, entry and exit points should be watched for suspicious activity, as well as where queues are formed and other high traffic areas. A strategic approach with panoramic, fixed IP or PTZ cameras will offer high-quality video performance with wide coverage and detailed footage, making it next to impossible to miss how an incident unfolded.

Secret Surveillance

While installing security cameras that are visible to anyone at a bank will provide in-depth coverage and can occasionally act as a criminal deterrence, there are definite benefits of deploying a system of discreet, unobtrusive cameras. Some camera lines have been designed to be compact and easily concealed; any financial institution will gain an advantage with hidden cameras or “secret surveillance”. They allow for greater coverage without making genuine customers feel uncomfortable, but most importantly, installing discreet cameras will virtually eliminate the possibility for criminals to evade being detected and subvert a bank’s security oversight efforts.

Advanced Video Analytics

Situational awareness starts with the camera’s ability to provide broader video intelligence. Cutting-edge analytics, leveraging algorithms powered by deep learning technology, is embedded or integrated separately into certain security camera models with intelligence at the core. With advanced video analytics, threat detection is improved, allowing security management at banks to quickly focus on urgent situations. This smart detection combined with predictive analytics afford banks with better decision-making and greater insight into behaviors and patterns.

Using video analytics, financial institutions can monitor critical areas where money is being handled or transferred, and set up alerts and special notifications to enable security officers to respond before situations escalate. Also, imagine the investigative power of video analytics when someone’s bank account has been compromised. To prevent fraud and tampering, analytics can be configured to detect potential incidents of skimming devices at ATMs or possible cash harvesting, sending alerts in real-time to pre-determined security management.

At a time when social distancing seems to be progressively more important, openly integrated video systems with advanced analytics can give banking institutions the ability to locate overcrowding and track the number of individuals travelling through, or even loitering within, a defined area using heat mapping and deep learning edge or cloud-based analytics. Similarly, many video security systems have been upgraded to help branches achieve compliance with health and safety policies, including elevated temperature detection of individuals at risk of potential infection, coupled with alerts and detailed tracking of site occupancy levels. This allows officials to reallocate staff or adjust best practices based on analyzed video or monitoring in real-time for rapid response.

Investing in Maximized Security

Employing the use of an advanced video security system should be a fundamental part of operations for banks and financial institutions today. Mission-critical assets, sensitive information and a surplus of money need to be optimally secured. By implementing state-of-the-art video technology, enhanced image quality, detailed coverage of critical areas, pivotal camera installation options and the power of advanced video analytics provide layers of actionable intelligence for comprehensive protection, safety assurance, crime monitoring and risk mitigation.

Author: Rochelle Thompson, Senior Vice President of Marketing, Pelco