The True Open Platform

While open platform is most common in technology, the concept exists in many sectors. Open platform is an approach where one company invites other companies to build applications o...

While "open platform" is most common in technology, the concept exists in many sectors. Open platform is an approach where one company invites other companies to build applications or offer products and services that can be used on their existing platform.[1] Instead of controlling the development pathway, the sponsoring company creates a proprietary interface and enables other companies to build products and services leveraging their assets.

As video surveillance industry insiders can attest, the open platform approach was adopted as a best practice within the past 10 to 15 years as it became apparent that Internet Protocol (IP)-based systems were overtaking incumbent analog systems. Many companies touted open platform development as the foundation for their integration platforms, which benefited this fragmented industry by enabling multiple companies to work together to support their specific customers' needs.

Alas, companies then proceeded to develop proprietary interfaces that forced customers to fall victim to vendor lock-in. Can a video surveillance platform really be open if the customer is dependent on one vendor to update interfaces to cameras and other third-party solutions? The notion of open platform has degenerated into "proprietary open platform," obliterating the benefits of managing a multi-vendor environment and future proofing the system. Vendors believe that they can provide greater functionality through proprietary interfaces than what's available in the standard. They also consider having a proprietary interface that doesn't support a standard as being a competitive differentiator.

It's time for a change. Trends indicate that the proprietary open platform will not give the industry the sustainable, profitable growth it needs or satisfy customer demand. This paper will review some of those trends, the benefits of a true open ecosystem and standards-based video integration platform, and how a team-based ecosystem approach can achieve this vision.

Trends Indicating a Need for Change

Decline in Industry Innovation

Perhaps the most glaring indicator that open platform has become proprietary open platform is the decline in industry-wide innovation. Most industries experience technological shifts that allow for increased innovation, as occurred when IP-based security systems first hit the market. There were massive improvements and new technology coming to market for what seemed like almost every day, on both the hardware and software sides. However, innovators now spend more time on user interfaces and software changes than on hardware changes. Similarly, in the telecommunications industry, companies are finding tremendous value in software-defined networking and are not focusing solely on switches and routers anymore.

The disruption that IP had on hardware and software - on cameras and video management systems (VMS) - has declined. Higher resolution cameras and increased features and functionalities within the VMS are not producing the innovative benefits that they once did.

High-resolution multi-megapixel cameras can cover larger areas without losing detail, which means system designers can use fewer cameras. Their superior resolution also "enables highly detailed and accurate digital PTZ (pan-tilt-zoom) of live and recorded images,"[2] making them preferable to costly, mechanically fragile PTZ cameras.

Nevertheless, 2- and 3-megapixel cameras are in the sweet spot of today's video solutions. Price pressure on IP cameras, storage implications for video captured by cameras larger than 5 megapixels, and IP network bandwidth competition with other services (including voice, video conferencing, software-as-a-service, and more) have allowed these 2- and 3-megapixel cameras to prevail in volume. They offer sufficient detail and manageable amounts of data at an affordable or rather acceptable price.

Though IP has been gaining market share over incumbent analog systems, high-definition analog cameras now compete well with IP cameras up to 2 megapixels. In some applications, these high-definition analog cameras may even work better, especially if legacy customers using analog aren't ready to make a forklift upgrade to IP. Hybrid solutions seem to be here for many years to come.

While proprietary open platform VMS innovation continues, customers are not willing to pay the higher price per license to support the cost. A telltale example of this phenomenon can be found in video analytics.

Questioning the Value of Video Analytics

Video analytics can offer immense value in the form of improving certain functions of a VMS, but overall it has not been the revolution many in the industry hoped it would be. For example, advanced motion detection helps reduce the number of people needed to monitor live video and increases efficiency, but at best it is a valuable add-on rather than a standalone solution. Facial recognition may assist in reducing the list of possible matches within a given sample, but other VMS and advanced data analytics resources and functions are needed to draw out the true value.

Popular movies and television shows misrepresent video analytics' capabilities, resulting in false expectations from end users. For example, recognizing the face of a criminal reflected in a puddle of water, zooming in on the face, and then using that video to detain the criminal isn't realistic in 2015. This would require an expensive, custom solution featuring a level of network and storage bandwidth, camera resolution, and data analysis that limits its availability to mainstream customers.

When it comes to video analytics, customers now have a choice. They can add a sophisticated layer of advanced video analytics or demand that basic analytics functions be included in their cameras or VMS. According to IHS, "For some time now, video surveillance device vendors have been embedding low-end video analytics applications in their devices and offering them as 'free' features...it's clear that vendors can no longer charge for basic algorithms."[3]

A true advanced video analytics platform requires expert setup from the solution provider. While it may include impressive funcionality such as facial recognition, bag left behind, intrusion detection, tripwire, and more, it also comes with a high price tag and greater demands on network resources. Customers also need expert support after implementation to keep the system running and understand the frequent, often counterintuitive, updates. To date, few verticals can afford these additional costs for both the implementation and long-term support. Typically, organizations trying to use advanced analytics rely on government funding (e.g., security organizations responsible for borders, ports, and government buildings).

The market is trending toward basic analytics functions integrated into VMS and cameras as being good enough. However, this is resulting in more proprietary behavior because solution providers have tried to include basic analytics functions such as motion detection and reduction of false positives as a sales differentiator.

Since customers already expect basic analytics functions to be included - or at least to be affordable add-ons - solution providers continue to spin their wheels, wasting time on incorporating functionality in proprietary solutions that are no longer innovative. As a competitive differentiator in choosing a specific video platform, video analytics has had little impact to date.

Higher VMS Expectations

In addition to basic video analytics capabilities, many customers now demand that other former standalone solutions be included as standard in their VMS platform, such as Physical Security Information Management (PSIM). PSIM adds situational awareness to video surveillance and backs up that awareness with situation management tools to accelerate and improve response. Companies that used to specialize in PSIM only - as a complete solution or on separate capabilities of collection, analysis, verification, resolution, reporting, or auditing - have been forced to expand their platforms to include VMS or integrate with a full solutions vendor. Otherwise, they become obsolete.

As we see the video hardware market commoditize, successful companies will add value through software. Equipment vendors, distributors, and integrators in specific verticals can differentiate with more complete and rich software solutions within these verticals. "As the market becomes more commoditized, vendors are increasingly looking for ways to stand out from the crowd, either through product or service features, or with the help of channel solution partners."[4]

"Siliconization" Driving Commoditization

Siliconization - defined as when valuable functionality becomes readily available on a silicon chip - has driven change in many industries. A complex network adaptor card became a simple LAN on a chip. Digital, analog, mixed-signal, and radio frequency functions became a system on a chip. Now, the functionality of an IP camera is available on a chip, and this siliconization is driving industry commoditization.

Commoditization is leveling the competitive landscape. Customers are not willing to pay for the extra features that some companies provide as "premium" when adequate features are available from other manufacturing platforms with aggressive pricing models. Consolidation will continue to be an industry trend as companies with economic models that don't address end user value and value creation may fall to the wayside.

According to Bill Bozeman, president and CEO of PSA Security Network, "Commoditization is the biggest problem facing today's security integrators." Large manufacturers use economies of scale to drive down prices, and lower prices will hurt video systems integrators' business. "You have to sell that many more cameras and card readers to create the same amount of revenue. There's a lot of danger there."[5]

Consolidation and the Rise in Proprietary Behavior

The video surveillance industry has been primed for consolidation for years. The evolution from analog to IP (or hybrid) solutions combined with the need for economies of scale have formed an opportunity for larger

Companies to consolidate a fragmented industry. Customers demand end-to-end solutions that seamlessly integrate cameras, software, and other components, and consolidation addresses that demand. Referring to one of many recent acquisitions, Jeff Kessler, Managing Director for Institutional Research at Imperial Capital, said, "This has proved out our five-year thesis on the vertical structure collapse of the video industry where (mainly) standalone software management and camera manufacturers - no matter how well regarded and no matter their technological leadership - are increasingly seen as parts of a much larger value proposition in video at the enterprise, institutional, and critical infrastructure level."[6]

This industry consolidation is also what's behind much of the proprietary influence on the so-called open platforms of today. When open platform camera manufacturers, access control companies, software developers, and integrators merge, the interfaces, drivers, and interactions are controlled by the dominant player, or "consolidator." Meanwhile, each proprietary have interface created by each player requires funding and expertise to keep updated, and the consolidators will need to accept these costs or try to pass them on to customers. Customer frustration grows because they must adapt to the interface of the most powerful player in the merger. Customers may find themselves at the mercy of a vendor they never worked with before, obligated to trust that the vendor is proactive about updates and patches for their system. In an industry where trust and security are key, this is a potential risk.

The consolidator expects value out of an acquisition and thus is likely to prioritize their own proprietary interface in order to gain more business. End users and integrators will be the losers here when they are locked back into a proprietary jail.

How to Move the Video Surveillance Industry Forward

The Standards-Based Video Platform

The only way to protect customers' investments and future-proof their IP video surveillance systems is to truly embrace open standards. Companies that want to survive the consolidation trend and achieve sustainable, profitable growth will need to build standards-based video integration platforms.

Free and uninterrupted access to the underlying code for camera drivers is a real strength of the true open standards approach. In-house or third-party developers can address bugs and issues immediately without needing to rely on a vendor, whose priorities and resources may not always align with customers.

Standards-driven organizations like Open Network Video Interface Forum (ONVIF) and the Physical Security Interoperability Alliance (PSIA) are committed to the adoption of IP in the security market and ensuring interoperability between IP-based physical security products regardless of the manufacturer. These groups are open industry forums and global consortiums focused on the development of a global standard and promoting interoperability.

Though they have been around for years, these organizations and their standards have unfortunately not taken off as they should had the industry truly embraced open standards. Ironically, the slow-down in innovation in the industry has given these forums the time they have needed to tighten standards, priming the industry to finally embrace a true open standards-based platform. Vendors within the physical security industry need to start pushing for this interoperability and utilizing development resources on standards-based integrations rather than on their own proprietary integrations or the whole industry loses. The end goal should be to empower the customers and provide open standards-based solutions that are truly open.

Offering free and uninterrupted access to the underlying code for proven and tested camera drivers is a springboard for reigniting innovation at the edge. "It's a huge ecosystem of innovators who are no longer competing for scarce resources but rather sharing knowledge with others to create new solutions and opportunities for others to benefit from these resources."[7] Moving forward, companies that will thrive in the IP video surveillance industry will innovate on standards-based video platforms. The cost and time-to-market benefits are necessary to keep up with the Internet of Things (IoT), 4K Ultra HD, HD over coax, body cameras, video surveillance as a service (VSaaS) and other new technologies that customers will soon expect to be standard functionality of their video surveillance platform and other physical security applications.

Developing a Team-Ecosystem

There is a huge ecosystem of innovators who, given the ability to truly partner with others, can create new solutions and opportunities. IP video surveillance vendors hold the key to embracing the open standards to create these partnerships. Vendors can make their software development kits (SDK) widely available in open-source bodies, thus enabling more companies within the ecosystem to differentiate the integrated systems. Using IP cameras as an example, a vendor who opens up their SDK allows integrators and other partners to write simple on-camera programs in order to create differentiated offerings and custom integrations for their customers.

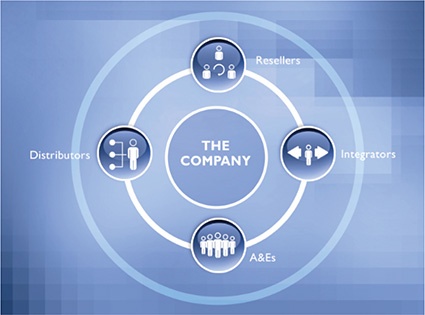

The creation of this "team-ecosystem" - inclusive of camera manufacturers, software developers, value-added resellers, distributors, access control companies, building management, IT, and many more - increases the likelihood that all the components essential to the development of a successful integrated security solution will work together as a true open standards-based solution. Customers will have access to systems tailored to their needs without needing to succumb to vendor lock-in.

Conclusion

As Memoori Business Intelligence states in their article, "The only long-term solution is to innovate, improve the quality and value of products and target growth markets."[8] Embracing open standards using open-source forums can foster this innovation. Instead of creating another proprietary solution comparable to a solution that already exists in the marketplace, industry leaders can channel research and development resources and investments toward other more creative work. Video surveillance companies can adopt open standards at a lower cost and focus their energy and efforts on bringing innovation to the industry.

Standards-based video integration platforms built according to tighter standards from ONVIF and PSIA offer the potential for IP video surveillance companies to create systems that are both flexible and future-proof. With innovation currently lagging, teamwork splintered, consolidation and commoditization continuing, and ever-increasing customer expectations, standards-based video integration platforms provide the video surveillance industry room to grow while allowing customers greater agility and flexibility. Those who emerge as industry leaders will be those who embrace a truly open and collaborative ecosystem - the Team Ecosystem.

References

[1] For more information, visit www.innovationinthecrowd.com/open-platform/

[2] Source: "Defining HD and megapixel camera resolution," June 21, 2011

[3] Source: "Video surveillance trends to look out for in 2014," December 18, 2013

[4] Source: "Top Video Surveillance Trends for 2015," January 14, 2015

[5] Source: "The Threat of Commoditization - And New Opportunities," September 29, 2014

[6] Source: "My Point of View: Industry Landscape Shifts with Increasing Frequency," March 23, 2015

[7] Source: "Open Source: A Platform for Innovation," Wired, November 2013

[8] Source: "The Chinese Video Surveillance Market - No. 1 Opportunity of No. 1 Threat?" January 13, 2015

Business Partner

Vicon Industries Ltd.Unit 4, Nelson Industrial Park, Hedge End Southampton United Kingdom

SO302JH Southampton

UK

most read

Assa Abloy's battery-powered Aperio KL100 secures lockers

Boost workplace security and operational flexibility by securing more than just doors.

Safety and Security in an Emergency: How companies take responsibility with strategic personal protection and amok prevention

Personal protection & amok prevention: strategic concepts, training & responsibility for corporate safety and security

GIT SECURITY AWARD 2026 - The winners have been announced!

GIT SECURITY AWARD 2026: The best safety and security solutions of the year - now an overview of all winners

When the Internet stumbles: Why DNS is important

When DNS fails, the internet stumbles-AWS outage proves resilience and redundancy are vital for digital trust

Is Your Venue Ready for Martyn’s Law?

Martyn’s Law demands stronger security by 2027. Is your venue prepared to protect and respond?