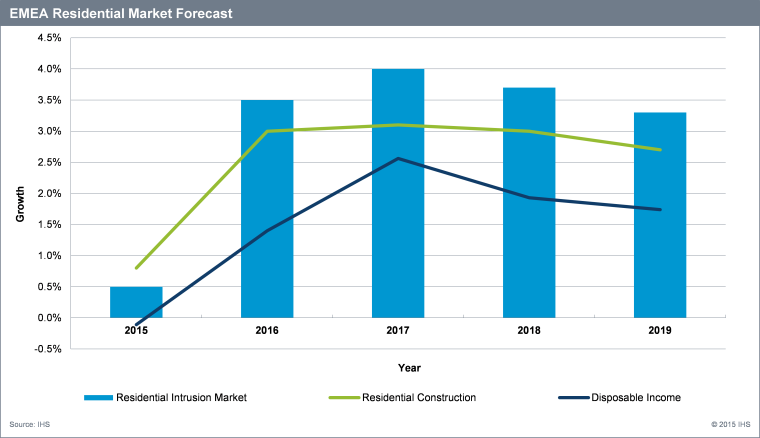

Residential market for Intrusion equipment in EMEA expected to surpass $500 million by 2019

Despite a sluggish start in 2015 the EMEA residential market for intrusion equipment is expected to exceed $500 million in annual market revenues by 2019, according to a new report...

Despite a sluggish start in 2015 the EMEA residential market for intrusion equipment is expected to exceed $500 million in annual market revenues by 2019, according to a new report from IHS Technology, entitled “The Market for Intruder Alarms – 2015.”

The residential sector is forecast to grow at a CAGR of 3% from around $440 million in 2014, as presented in the attached figure. The residential market is currently being negatively affected by the current political instability in Ukraine and surrounding areas of Eastern Europe however as these pressures and the corresponding economic uncertainty subsides IHS predicts stronger growth driven by recovering construction rates, a greater availability of disposable income and the increasing popularity of wireless products and home automation in Western Europe.

The evolution of the smart home and smart security systems has already started to take form across the Atlantic in the US, which is not only increasing the penetration rate/installed base of products but is also increasing the average spend of consumers. The capability to integrate a control panel with the smartphone offers benefits to users such as getting an alert when the alarm is turned off from children getting home from school or the ability to remotely arm the system. This increased functionality has become a key driver of market growth.

In EMEA, energy management remains the leading driver for consumer demand due government incentives and the lure of a financial return on investment for the consumer, security is only a secondary thought in purchasing a home management system.

However in a similar fashion to that of the US market, a number of European MSO’s are beginning the test the water with new smart security offerings, Orange introduced its “Inteligentny Dom” product to Poland in 2013 and its “Homelive” Z-Wave product to France in 2014 while SRF also rolled out its offering “SRF Home” to France in mid-2014. However these companies are still at the “pilot” stage of market entry, IHS believes it could take up to 2 years before there is any significant impact on the residential market.

There is evidence to suggest that the more traditional suppliers of the European intrusion market are also looking to capitalize on the shift in demand, just under a month ago in London manufacturers provided IFSEC with a whole range of new building automation and wireless products to showcase. Thermostats, cameras, intercoms, environmental sensors, lighting were all on display as well as brand new technology in the form of wireless photoelectric security detectors.

The entry of MSO’s to the home security space is also expected to speed up the transition towards a greater use of wireless security products; wireless sensor and control panel sales in particular are expected to grow at a faster rate than previously predicted. Significant improvements to battery life, a greater availability of affordable products and increasing labor costs are also facilitating this trend.

Note: Residential construction and disposable income index growth rates are aggregated from individual country estimates that are then weighted by relevant intruder alarm equipment market sizes.