The Global Physical Security Products Market is worth 19.17 billion USD in 2011

Memoori publishes a new report on the global physical security market, bringing together all the factors that influence this industries future.The total value of physical security ...

Memoori publishes a new report on the global physical security market, bringing together all the factors that influence this industries future.

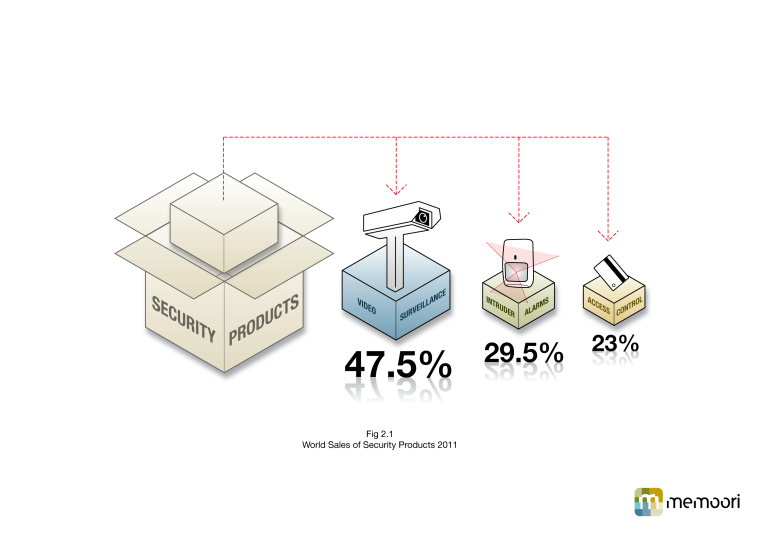

The total value of physical security world production at factory gate prices is $19.17 billion." Of this video surveillance products at $9.1bn take a share of 47%. The developed markets of North America and Europe are losing market share to Asia and particularly China, which will be the largest single market by the end of this decade.

The anticipated aftershocks from the 2008 financial meltdown and current sovereign debt crisis will dampen future growth, but the industry is resilient and demand will edge forward at a rate of 3.7% (CAGR) over the next 5 year period. This growth will need to come from the enormous latent demand for security equipment waiting to be exploited in the emerging markets of the world.

In a troubled economic climate the physical security industry has increased revenues and profitability whilst M&A has surged ahead by more than double in the last 2 years, to $9.847bn.

This is still a fragmented market despite 2% of the players taking 49% of the product business. The reason for this is that the massive growth in consolidation during the last 2 years has centered on acquisitions at the top end of the market and much of this has been made by companies outside the business.

Many of the traditional major suppliers have not taken part in the recent surge in deals but have chosen to expand their systems integration services over their product business. Our report questions why the market leaders, hitherto major exponents of growth through acquisition, have adopted this policy when 49% of the value of acquisitions made in the last 12 months came from companies outside the industry.

Indeed these new entrants from Defense and IT related industries see opportunities to leverage their technological expertise and with their financial muscle will contribute much to the future growth of this industry.

Falling IP prices together with much easier to install products and improved performance have all conspired to increase the Return on Investment (ROI) and total cost of ownership of this fast growing technology. The manufacturers and system integrators that will lead in the future are those that have invested in this technology and skilled staff.

There is only one solution to reducing the impact of a recession on demand and that is to continue with the innovation program of delivering more effective systems at lower prices. This was the main reason for the industry coming out of the recession in 2010, faster and in a much better shape than others.

About the Report

At 140 pages with 17 charts and tables, "The Physical Security Business in 2011" report filters out important conclusions, supported with facts, as to what is shaping the future of the physical security industry. It is a definitive resource for physical security products, uniquely combining clearly defined market sizing statistics with financial analysis of M&A, funding and alliances.

The report contains critical intelligence for all those managing, operating and investing in physical security companies around the world. You can learn more at the reports website; http://memoori.com/market-research/7-research-reports-1

Contact

Memoori Business Intelligence Ltd

Jim McHale, Director

support@memoori.com

+44-1494-722177