Facts and Figures of the UK Electronic Security Market

The total UK electronic security market of products electronic access control, intruder alarms and closed circuit television (CCTV) and associated services was estimated at appro...

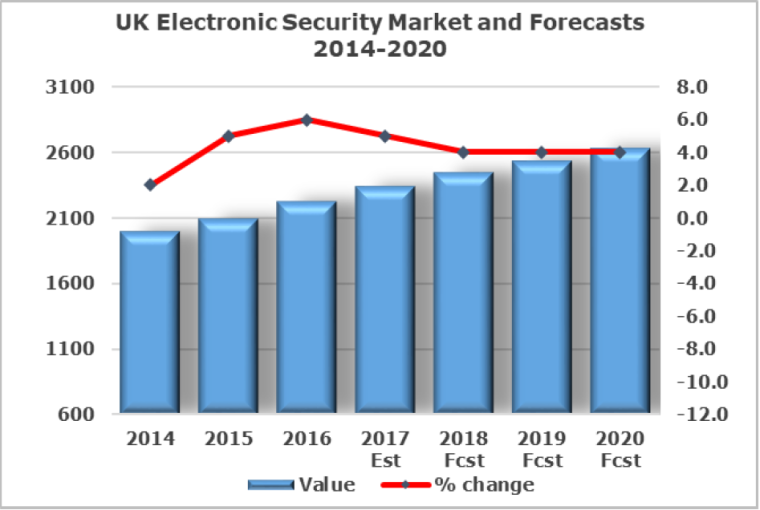

The total UK electronic security market of products – electronic access control, intruder alarms and closed circuit television (CCTV) – and associated services was estimated at approximately £2.35bn in 2017. This was an increase of around 5% during the year, and followed two years of strong growth in 2015 and 2016. These are just some of the salient facts that AMA Research have compiled into their ‚Electronic Security Systems Market Report – UK 2018-2022‘.

Market growth was driven by technological advancements boosting replacement demand, and improving new build and RMI expenditure across key market sectors. CCTV accounts for the majority of the market in value terms, with a 52% share. This sector has seen the greatest levels of innovation and new product development, and the recent shift in focus by major Chinese manufacturers from cost to technological development has eased the level of price competition over the last year or two. Technology has also become more affordable, leading to a continued shift away from analogue to digital products.

In the access control sector, product development and wider availability of products have been a key driver of growth as has the performance of the UK construction sector, particularly in commercial offices and house-building. In addition, access control products have not been subject to price deflation experienced in other sectors, thereby enabling relatively consistent value growth.

The intruder alarm market experiences long replacement cycles and a high level of competition in relation to other security options, particularly in the non-residential sector. However, in the residential sector, growth has remained positive in line with increased house-building and product development focused on ease of installation.

Combine and Conquer

Integration has continued as a key theme, both between products within the electronic security sector and also beyond, with wider business enterprise systems within Smart Buildings and home products within Smart Homes. The development of smart home products and integration with other security products and home management systems should offer significant opportunities for value growth. „Increasing competition remains a key feature of the market, with many established competitors struggling to maintain market share, due to intense competition from Chinese companies at all levels of the market“ said Hayley Thornley, AMA‘s Head of Research. „This in turn has led to significant merger and acquisition activity in the market since 2015, with companies aiming to achieve scale and provide end-to-end solutions.“

The prospects for the electronic security sector overall are reasonably good. Value growth is likely to come from increasing adoption of new technologies in both the new and replacement sectors. While construction output growth is expected to ease over the next 2–3 years, output remains relatively high by historical standards and this should continue to provide opportunities for manufacturers and installers of electronic security equipment. Government capital spending levels are also set to increase, particularly in infrastructure and also in local government and health. These are all potential opportunities for electronic security, particularly with the recognition that some of the public sector installed base has become outdated and fallen behind in technology terms due to spending cuts and austerity. The ‚Electronic Security Systems Market Report – UK 2018-2022‘ report is available now and can be ordered online or by phone using the details below.